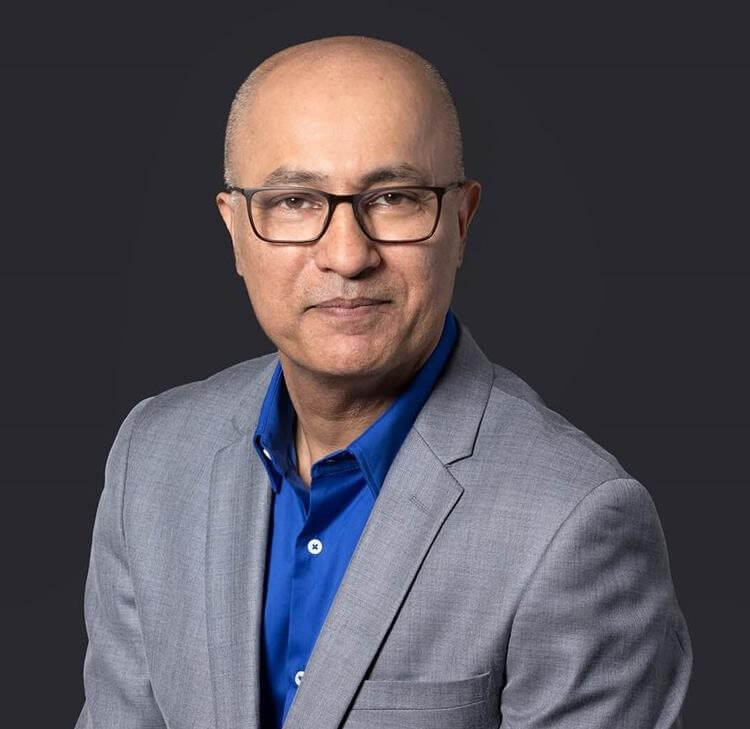

Browne Jacobson appoints new head of banking for Manchester to spearhead growth

Browne Jacobson has appointed Graham Ball as the new head of its banking and finance team in Manchester following a period of sustained growth for the firm’s national banking practice.

Browne Jacobson has appointed Graham Ball as the new head of its banking and finance team in Manchester.

The appointment follows a period of sustained growth for the firm’s national banking practice which is on track to deliver 20 per cent growth for the 2021/22 financial year.

Graham has considerable experience advising both lenders and borrowers on all types of debt finance including acquisition finance, asset based lending, real estate finance, debt restructuring and general corporate lending. He also has extensive experience advising corporate clients and private equity houses on sponsored transactions.

Graham has been listed as both a “key lawyer” and “recommended” in the UK Legal 500 in the last three years and joins from the Manchester office of Squire Patton Boggs where he was a legal director in its Financial Services and Banking Team.

Paul Ray, National Head of Banking and Finance at Browne Jacobson, said:

“We are delighted to welcome Graham whose arrival is a great boost for our banking practice.

“Building our Manchester presence and business is a key component of our overall growth strategy.

“With over two decades of experience in the banking sector Graham has all the credentials needed to build on the presence and credibility we have established over the last few years and fulfil our ambition of having a top tier banking practice in Manchester.”

The appointment is the first in a series of significant appointments Browne Jacobson is looking to make as it plans to expand its operations in Manchester following a period of sustained growth which has seen the office post 9 per cent revenue growth for 2020/21, marking a 74% increase in revenues for the office since 2017/18.

Dai Durbridge, Head of Browne Jacobson in Manchester, added:

“We are delighted to have Graham come on board.

“It has been a challenging 18 months for everyone but our appetite for growth and investment in our teams since we first opened in Manchester nearly ten years ago has never waned.

“As a firm and office, we continue to go from strength to strength and it’s an exciting time to be joining us.”

Graham Ball, Manchester Head of Banking said:

“I am delighted to be the firm’s new head of banking in the North West.

“The potential to grow the banking practice in the region even further was a major factor in my decision to join the firm and I am very excited at the challenge that lies ahead.”

Browne Jacobson’s banking team has extensive expertise in all aspects of banking and finance from corporate lending transactions, real estate financing, acquisition and leveraged finance to asset based lending, debt refinancing and restructuring work. It acts for a wide range of public and private sector clients including some of the UK’s leading banking institutions, local authorities, and housing associations.

Related expertise

You may be interested in...

Online Event

Wellbeing and financial considerations – practical solutions for challenging times

Legal Update

ESG in 3D - March 2023 (Edition 1)

Legal Update

Product distribution – how to protect yourself from an early exit

Legal Update

“Being on display in a zoo” is oppressive for luxury flat owners as the Tate Modern is found to be liable in nuisance

Legal Update

Court of Appeal considers law and jurisdiction clause within suite of multi-risk policies across Gulf jurisdictions

Legal Update

Green Leases for the NHS

Legal Update

California bomb cyclone set to ‘to exceed $1bn’ in storm damage costs

Legal Update

Systemic Event Risks: the need for a customer-centric approach to policy drafting

Legal Update

The rising number of cyber-attacks

Legal Update

Out of this world insurance – proposed changes to orbital liability and insurance

Legal Update

The continued threat of piracy in Southeast Asian waters

Legal Update

(Another) case on the importance of clear drafting

Legal Update - The Word

The Word, January 2023

Press Release

Insurance claims frequency and severity set to increase in 2023, according to leading law firm Browne Jacobson

Legal Update

Insurance Insights 2023

Press Release

Browne Jacobson's London FinTech team celebrate new Chambers 2023 rankings

Press Release

Browne Jacobson’s banking & finance team describe 2022 as a “game of two halves” after completing over £2 billion worth of transactions

Legal Update

Banking Transaction Updates - January 2023

Press Release

Manchester dealmakers advise Maven Capital Partners on £1m investment in fintech disruptor Nivo Solutions

Published Article

Consumer duty part 3 - 'The drill-down' into the 'cross-cutting' rules

Legal Update

Code of Conduct for ESG data and ratings providers – bridging the authenticity gap

Legal Update - ESG in 3D

ESG in 3D, December 2022

Legal Update

COP15: The most important unknown summit?

Legal Update

Long live king coal?

Legal Update

Code of Conduct for ESG data and ratings providers

Legal Update

All the pieces of the conduct puzzle: Governance, culture, D&I, innovation

Legal Update

Voluntary offset markets for carbon – a bad atmosphere?

Legal Update

Sustainable finance - great opportunity but there are risks for businesses that do not engage

Published Article

Starling Bank employment tribunal

The outcome of the Employment Tribunal claim brought by Gulnaz Raja against Starling Bank Limited (1) (Starling), and Matthew Newman (2) was reported last month.

Published Article

EU banks show slow progress on gender diversity

On-Demand

The UK's green agenda - the outcomes of COP27 and actions since COP26

Published Article

Consumer duty part 2 - 'The drill-down' into the 'cross-cutting' rules

This article is the second in a series to help firms take a practical approach to complying with the ‘cross-cutting rules’ within the new ‘Consumer Duty’ (CD) framework. The article summarises what it seems the Financial Conduct Authority (FCA) is seeking to achieve from the applicable rules (section 2 below) and potential complications arising from legal considerations (section 3).

Legal Update

Five “takeaways” in claims against mortgage brokers following Taylor v Legal & General Partnership Services Ltd [2022] EWHC 2475 (Ch)

Claims arising from interest-only mortgages have been farmed in volume. Many such claims to date have sought to drive a narrative that interest-only mortgages are an inherently toxic product and brokers were negligent simply for suggesting them. Taylor is a helpful recalibration, focussing instead on what the monies raised by the mortgage product were being used for and whether the client understood the inherent risks.

Legal Update

Trigger happy when directors’ duties are the target?

In a judgment handed down yesterday the Supreme Court has affirmed that a so called “creditor duty” exists for directors such that in some circumstances company directors are required to act in accordance with, or to consider the interests of creditors. Those circumstances potentially arise when a company is insolvent or where there is a “probability” of an insolvency. We explore below the “trigger” for such a test to apply and its implications.

Legal Update

The Retained EU Law

Created at the end of the Brexit transition period, Retained EU Law is a category of domestic law that consists of EU-derived legislation retained in our domestic legal framework by the European Union (Withdrawal) Act 2018. This was never intended to be a permanent arrangement as parliament promised to deal with retained EU law through the Retained EU Law (Revocation and Reform) Bill (the “Bill”).

Opinion

Sequana: Supreme clarification on the duty owed to creditors

The Supreme Court has unanimously dismissed the BTI v Sequana appeal and reviewed the existence, content and engagement of the so-called ‘creditor duty’; being the point at which the interest of creditors is said to intrude upon the decision-making of directors of companies in financial distress.

On-Demand

Enforced ESG sustainability: prepare for the planned and the possible

Published Article

Consumer duty part 1 - 'The drill-down' into the 'cross-cutting' rules

This article is the first in a series aimed to help firms get to grips on a practical basis with the ‘cross-cutting rules’ within the new ‘Consumer Duty’ framework.

Opinion

IR35 rules to be scrapped from April 2023

The Chancellor’s recent mini-budget provided a significant announcement for business as it was confirmed that the off-payroll working rules (known as “IR35”) put in place for public and private sector businesses from 2017 and 2021 will be scrapped from April 2023.